How Solar Power Can Save You Money in the Long Run

As concerns about climate change and rising energy costs grow, homeowners are increasingly looking for sustainable energy solutions. Solar power has emerged as a top contender, offering both environmental benefits and significant financial savings. With the added advantage of solar power incentives provided by federal and state governments, making the switch has never been more appealing. While the initial installation costs might seem daunting, the long-term benefits of solar energy make it a worthwhile investment.

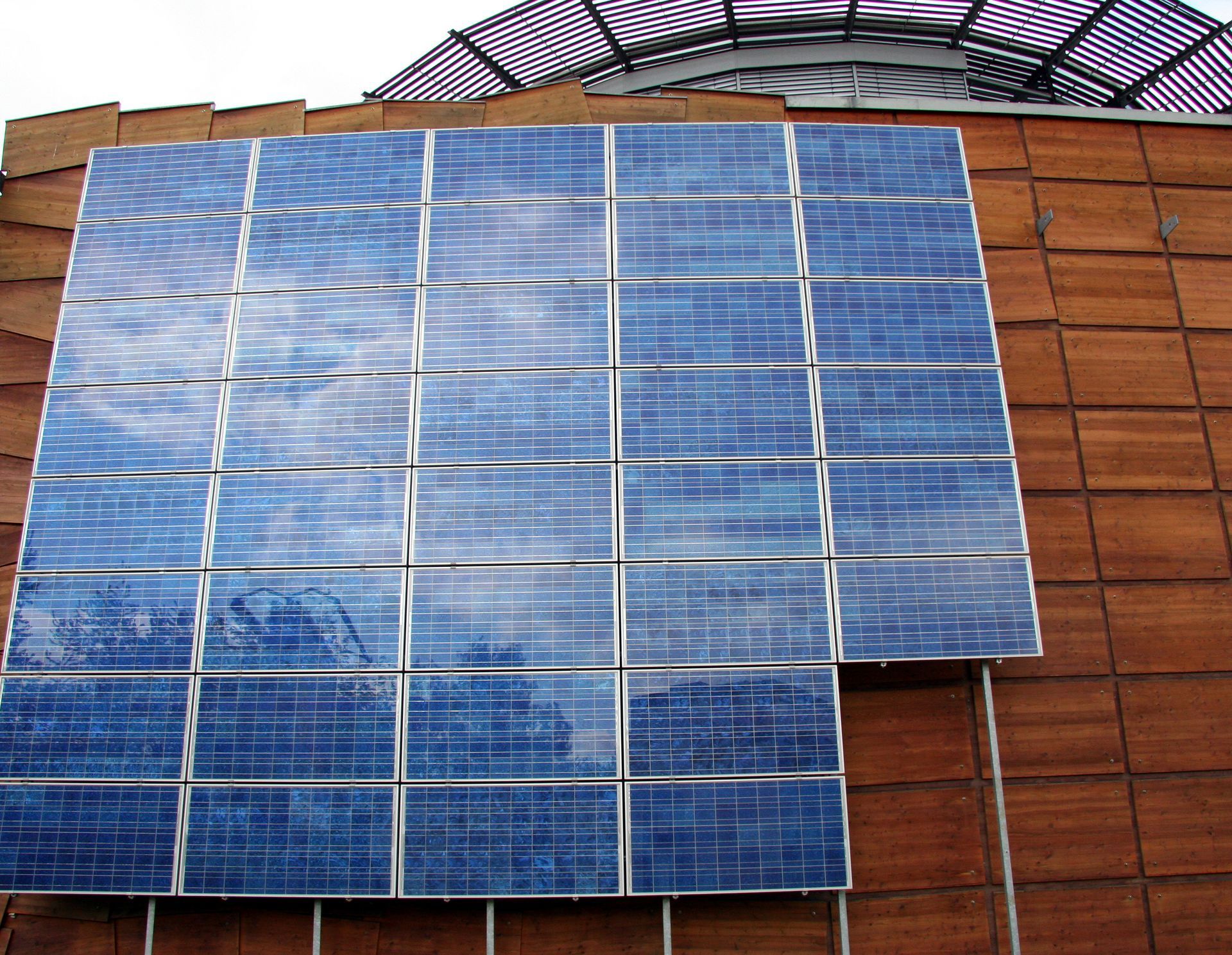

Reduce Electricity Costs and Gain Energy Independence

One of the most compelling reasons to transition to solar energy is the potential for reducing electricity costs. Traditional energy prices fluctuate due to market demands and geopolitical events, leading to unpredictable utility bills. By installing solar panels, you can harness free sunlight to produce electricity, significantly reducing your dependence on the grid. Over time, this energy independence translates into consistent and substantial savings.

In the past decade, the cost of installing solar panels has dropped dramatically. According to EcoWatch, the average residential solar system costs between $10,290 and $20,580 in the United States. While this upfront investment may seem substantial, many homeowners discover that their reduced utility bills offset these costs within just a few years. Financing options, such as leasing agreements and solar loans, make it easier to spread the costs over time, making solar power more accessible to a wider audience.

Maximize Savings With Solar Power Incentives

Government solar power incentives play a crucial role in enhancing the financial appeal of solar energy. The Federal Solar Tax Credit, for example, allows homeowners to deduct a significant portion of their installation costs from their federal taxes. Many states also offer additional programs, including rebates, tax exemptions, and performance-based incentives, which further reduce the financial burden of going solar. These solar power incentives not only lower the initial investment but also shorten the payback period, making solar energy an even more attractive option.

Boost Property Value With Solar Energy

Solar power doesn't just save you money on energy costs — it also increases the resale value of your home. Properties equipped with solar panels are often seen as more desirable because of their ability to lower utility expenses and support sustainable living. Studies show that homes with solar energy systems sell faster and at higher prices than those without.

As energy efficiency becomes a growing priority for homebuyers, solar panels can give your property a competitive edge in the real estate market. Investing in solar energy is not just a step toward reducing your carbon footprint but also a strategic move to enhance your home's market value.

Protect Yourself Against Rising Energy Costs

Utility rates have historically trended upward, and future increases seem inevitable. By investing in solar energy, you can lock in lower electricity rates for decades. This stability shields you from the financial strain of fluctuating energy prices and provides a sense of predictability for your household budget. Solar power is not just a tool for sustainability; it is also a safeguard against the uncertainty of rising utility costs.

Understand the Long-Term Financial Benefits of Solar Power

The initial expense of solar panel installation may seem intimidating, but the long-term savings are undeniable. Reduced utility bills, increased property value, and protection from energy price hikes all contribute to the financial advantages of solar power. When you factor in solar power incentives, the return on investment becomes even more compelling.

Solar power incentives continue to drive the adoption of renewable energy across the country. These programs make solar energy more affordable and accessible, ensuring that more households can take advantage of its benefits. As the solar industry evolves, ongoing innovations promise to make these systems even more efficient and cost-effective.

Look Forward to a Bright Future With Solar Energy

Solar energy is an investment in both the planet and your wallet. By taking advantage of solar power incentives, reducing your utility bills, and boosting your property value, you can achieve financial security and sustainability in one step. As technology advances and governments continue to support renewable energy, now is the perfect time to consider how solar power can benefit you in the long run.

By harnessing the power of the sun, you're not only making a positive environmental impact but also securing a brighter and more financially stable future. With solar power incentives making the transition easier, there has never been a better time to turn your rooftop into a source of savings and sustainability.

Discover how solar energy can transform your home or business with expert guidance from Northwind Solar. From reducing utility costs to taking full advantage of solar power incentives, we'll help you every step of the way. Start your journey toward a sustainable future—schedule your free consultation today!

Share On: